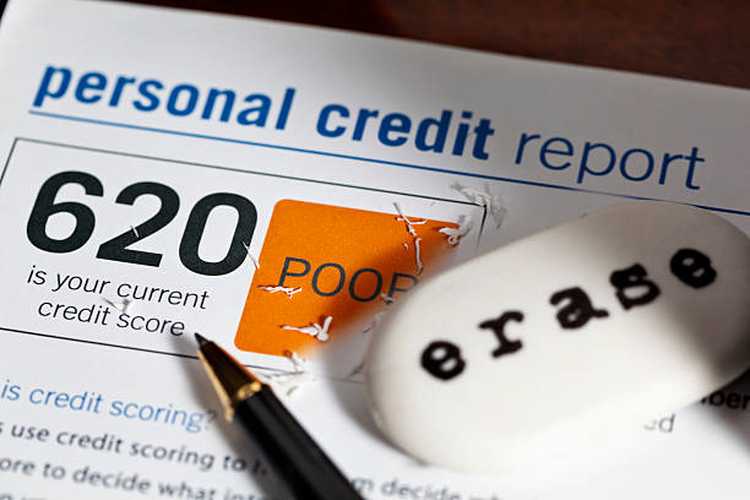

If you need to get a loan, it is imperative to fix your broken credit score. A better credit score when applying for a home or auto loan means you’ll have better rates and options.

Credit card companies, banks, and car dealerships report your payment histories to credit agencies like FICO and Equifax that rate your scores based on how consistently you make payments. If you have ever run into financial trouble that caused you to miss payments or default on loans, your score could be suffering, subjecting you to high interest rates and trouble being approved for new lines of credit. Luckily, there are ways to raise your score.

1. Track your Credit Report

Credit history repair Philadelphia PA specialists can help you go over your credit reports in detail and find out what accounts are causing the problems. They may be able to help you find and fix account status errors on your reports that could be dragging your score down.

2. Get a Secured Credit Card

A credit card is considered secured when it requires you to put money down as a security deposit to open the account. This security deposit usually serves as your credit limit, and you can use the card to make scheduled payments like utilities, phone, and internet bills. Do your research on different card providers. Not all of them report secured card activity to credit agencies, so be sure to go through one that does.

3. Become an Authorized User

If you have a family member who’s willing to help you out, they can add you as an authorized user on their account. The account holder, preferably one with good credit, is still responsible for all of the payments. Authorized users are, depending on the card provider, reported to credit agencies separately from the account holder, regardless of whether they actively make purchases on the account or not.

Even if the credit reporting and calculation processes are complicated, there are still simple steps you can take to raise your score and open up new and better credit opportunities. However, to keep your finances in tip-top shape, you also need to consider getting out of debt.